Legal Bill Review (LBR) is a process where you review law firm and other legal support supplier invoices to ensure compliance with billing guidelines and avoid overpayment. The primary goal of legal bill review is to manage legal spending, but there’s also a growing emphasis on improving the quality of legal spend data.

In this article, we’ll cover everything from the legal bill review workflow and the technologies used, to billing guidelines and invoice adjustments and appeals. So, let’s get started!

What’s Legal Bill Review

Legal bill review is essentially an audit of legal invoices to ensure compliance with billing guidelines and avoid overpayment. The process involves reviewing each invoice line-by-line, identifying non-compliances with billing guidelines, and making relevant adjustments to the invoice.

Non-compliance with billing guidelines can take many forms, including block billing, vague or insufficient descriptions, overhead costs billed to clients, and expenses billed without supporting documents. Depending on the client’s billing guidelines, the number of non-compliances can range from 20 to 45.

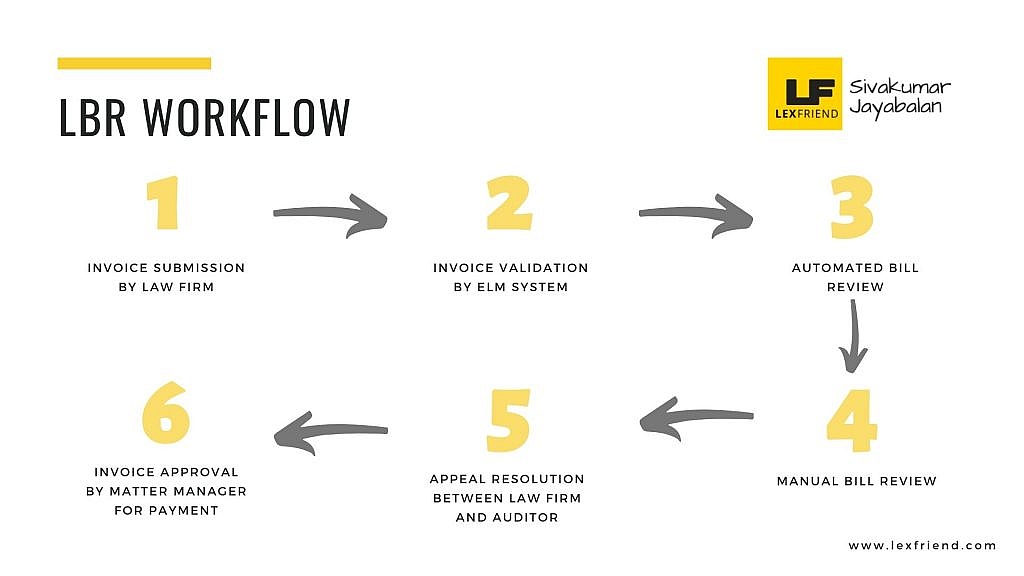

To give you a better idea of what the legal bill review process looks like, here’s a high-level workflow:

Pretty straightforward, right?

Enterprise Legal Management (‘ELM’) Software

Enterprise Legal Management (ELM) software has become a must-have for legal departments and law firms to manage their legal matters, expenses, and operations efficiently. ELM software offers a range of functions, including matter management, invoice management, legal spend analytics, e-billing, and legal bill review.

In recent years, the market for ELM software has grown rapidly, and several companies now offer different ELM solutions. Some leaders in this space include:

- Brightflag

- CaseFox

- LexisNexis CounselLink

- LSG Mercury ELM

- Mitratech eCounsel

- Onit

- SimpleLegal

- Thomson Reuters Legal Tracker

- Wolters Kluwer Passport

ELM is especially important for legal bill review, which involves auditing legal invoices for accuracy and compliance with fee arrangements. With the adoption of ELM, clients can receive invoices in a standard structured data format, making it easier to review and analyze them.

However, the features related to legal bill review vary among different ELM providers, so evaluating the user-friendliness and efficiency of an ELM system before adopting it is essential. The functional touchpoints of a legal bill review auditor in an ELM system can significantly impact the underlying invoice data, so choosing the right ELM system is crucial.

Electronic Invoicing /eBilling

Have you heard of the LEDES invoices? LEDES, which stands for Legal Electronic Data Exchange Standard, is a widely recognized format for exchanging legal invoices electronically. The LEDES Oversight Committee maintains the LEDES invoice data specifications, which is a mutual benefit corporation.

As a bill reviewer, you might not need to know all the technical aspects of the LEDES invoice format, but understanding some of the standard data elements used in these invoices can be helpful. Four codes are particularly important: Phase Code, Task Code, Activity Code, and Expense Code. These codes come from the Uniform Task-Based Management System, also known as UTBMS.

The UTBMS codes provide a standardized categorization of legal work and expenses, making it easier for clients to analyze and compare legal invoices across different matters and law firms. The development of UTBMS resulted from collaborative work among the American Bar Association, the American Corporate Counsel Association, and a group of major corporate clients and law firms. UTBMS is currently developed and maintained by the LEDES Oversight Committee.

It’s worth noting that the Phase and Task codes of UTBMS are specific to different practice areas, including litigation, eDiscovery, counseling, project, bankruptcy, patent, and trademark. However, the activity and expense codes apply to all practice areas.

In conclusion, understanding the LEDES format and UTBMS codes is crucial for bill reviewers and clients to analyze and compare legal invoices across different matters and law firms. Using standardized legal work and expense codes, clients can have greater visibility and control over their legal spending.

The Billing Guideline Non-Compliance Matrix (“GNC Matrix”) is a document that outlines the scope of legal bill review. The GNC Matrix is created by extracting details from the client’s billing guidelines and other industry best practices.

The GNC Matrix consists of three main sections: GNC Heading, Adjustment Reason/Comments, and Adjustments. The GNC Heading provides a short description of the non-compliance, such as Block Billing, Vague Description, or Overhead Expenses. The Adjustment Reason/Comments section provides a detailed explanation of why an invoice line entry is flagged with a guideline non-compliance. This section typically includes relevant citations from the client’s billing guidelines.

The Adjustments section provides the value of adjustments to invoice line entries based on the non-compliance identified. The adjustments may include reducing the amount to zero, reducing the amount by a percentage, reducing units by a percentage, or setting the amount or units to a specific value.

In addition to these sections, the GNC Matrix may also include a section on the Scope for Automation. This section provides logic and algorithms for automating adjustments based on the non-compliance identified. For example, if the non-compliance is related to “Travel Time,” the line item amount should be automatically reduced by 50%. Another example would be if the activity code used is A112 (i.e., UTBMS Activity code for travel time), the system should automatically apply the non-compliance for “Travel Time.”

Overall, the GNC Matrix is an important tool for bill reviewers and clients to ensure compliance with billing guidelines and industry best practices, as well as to streamline the legal bill review process.

If you want to master the art of legal bill review, you should start from the GNC Matrix. Review the available one, and then prepare one of your own.

Automated Legal Bill Review

Automated bill review has become very much a part of any ELM system currently available in the market.

Automated bill reviews can identify non-compliances and adjust or reject invoices.

These automated invoice validations help reduce unnecessary manual efforts. However, at present, you cannot wholly avoid manual intervention. The scope of automation has a dependency on the quality of the invoice data.

UTBMS codes utilized in the LEDES invoices play a crucial role in enabling most of the automated validations.

Below are some examples:

- Invoice Amount v. Budget – if the invoice amount is higher than the approved budget estimation, the system will automatically reject the invoice.

- Timekeeper Rate – if the timekeeper rate submitted in the invoice is higher than the approved rate for the timekeeper, then the system will automatically reduce the timekeeper rate to the agreed rate.

- Duplicate Line Entries – if the invoice consists of duplicative line entries, the system will automatically reduce the Amount billed for such duplicate line entries.

- Photocopying Charges – if photocopying charges are billed at a rate higher than the agreed rates, the system will automatically adjust the rates to the agreed rates.

- Overhead Expenses – if any overhead expenses are billed, the system can automatically detect and reject such billing entries. e.g., postal charges, fax, local travel, word processing, etc.

In addition, there are other semi-automated bill reviews that work as a system aid for better manual invoice review. These system validation flags indicate a possible billing guideline violation that requires an auditor’s review to finalize. Below are some examples:

- Possible Block Billing – depending upon the wordiness of the invoice line entry narrative and the combination of specific keywords that indicate different activity types, the system can flag a line entry as ‘possible block billing.’

- Possible Vague Entry / Insufficient Description – if the invoice narrative displays only a couple of words or much lesser text characters, the system will flag those line entries as a ‘possible vague entry.’

- Possible Travel Time – if the activity code is A112, the system will flag the line entry as ‘possible travel time.’ Similarly, the system also uses expense codes such as E104 – Facsimile, E105 – Telephone Call, E108 – Postage, E109 – Local Travel, E111 – Meals to flag them as overhead expenses.

Manual Legal Bill Review

Most Enterprise Legal Management (ELM) systems with electronic billing (eBilling) also have manual bill review functions that allow users to audit invoices line by line and adjust the invoice amount at the line entry and invoice levels. Although many ELM providers claim that their systems have artificial intelligence to replace manual legal bill reviews, this is not yet a reality due to various reasons.

During manual bill reviews, auditors pay close attention to details to ensure compliance with billing guidelines. They also review items that are automatically adjusted by the system. The approach to bill review may vary from client to client, depending on the engagement terms, billing guidelines, and high-level objectives of the clients behind employing legal bill review.

Here are some best practices that I have employed or recommended for various clients.

- Block Billing – Block billing is the practice of billing multiple activities within a single invoice line entry. To determine if a line item is block billed, it is essential to check if the activities billed in a line item can attract more than one UTBMS activity code.

- Staffing Issues – Staffing-related billing issues may include attendance time billed by multiple timekeepers, paralegal tasks billed by attorneys, replacement timekeeper billing time for reviewing case files to familiarize with the matter, and lead attorney billing for supervisory time.

- Insufficient Descriptions – Commonly found insufficient descriptions include communication time billed without details of the parties involved and the subject matter of the communication, document review time without mentioning the volume of the documents reviewed (specifically eDiscovery work), and time entries with “prepare for . . .” and “work on . . .” without specifying the actual task performed.

- Expense Items – Expense line entries can be reviewed to identify and reject law firm overhead items billed to clients (e.g., local travel, postage, facsimile, local meals, telephone calls, etc.) and verify expense items with supporting documents and receipts.

- Activity & Expense Codes – This is a recent addition to the bill review items, especially for clients focusing on improving the quality of legal data. This review ensures that appropriate activity and expense codes are utilized in the invoice line entries.

Appeal Resolution

Appeal resolution is the final step in the process where auditors and law firms negotiate and resolve any invoice adjustments related to disagreements.

This process can be complex, and one of the challenges is the need for more understanding of billing guidelines among law firms, leading to incorrect appeal submissions. For example, a law firm may appeal a reduction by stating that the task performed is reasonable without addressing the compliance issue. This renders their appeal comments irrelevant and prolongs the appeal process.

To address this challenge, it is recommended that you take proactive steps to educate law firms about billing guidelines compliance. Here are some recommended actions you can take:

- Provide training sessions for law firms on billing guidelines compliance. This can be done through webinars or in-person sessions. During these sessions, cover the specific billing guidelines applicable to your organization and provide examples of compliant and non-compliant invoice line entries.

- Share feedback with law firms on their incorrect appeal submissions. When an incorrect appeal is submitted, share feedback with the law firm on what they could have done differently to make the appeal more meaningful. For example, if a law firm submits an appeal stating that the task billed is reasonable, remind them that compliance with billing guidelines is essential to determine the reasonableness of the time charged.

- Establish clear communication channels with law firms. Encourage law firms to ask questions and seek clarifications about compliance with billing guidelines. This can be done through regular meetings, email communications, or providing a hotline for queries.

By taking these proactive steps, you can help law firms better understand billing guidelines compliance and submit more meaningful appeals. This will reduce the appeal process’s complexity and ensure that clients receive quality invoice data.

Remember, the ultimate goal of the legal bill review process is to ensure that clients are billed accurately and fairly. By working together and providing clear communication, bill reviewers and law firms can achieve this goal and build stronger relationships.

We’ve covered a lot of ground in this article, and I hope you’ve found it informative and helpful.